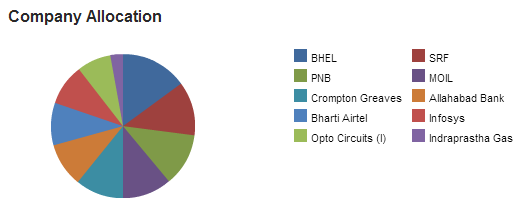

I took the first step of what I mentioned in planned investments. The new allocation looks as below

Here's the detail:

1. ALBK has run up from a low of Rs 117 odd to Rs 150 in last 40 days. This is quite fast. I did some bottom fishing around Rs 125 and below, and considering that I only took it as a beaten down stock, and not really a great long term investment, I should reduce some exposure and take profits. I did so, and reduce about 14% holding yesterday at Rs 150. As the stock will increase further, I'll offload further, and bring down portfolio contribution of ALBK to less than 7%, and possibly exit completely if I stop a much better opportunity.

2. CROMPGREAV has also run up from a low of Rs 103 to Rs 130 pretty fast. Again, prudent to reduce some exposure considering quite high a cost in comparison to IV as mentioned in my post earlier. It'll come down when people get sense out of this liquidity driven rally, and then I'll buy back again when it comes below the IV. Yes, it may not happen, but then I'll only offload upto 20% of my holdings. I reduced about 12.5% yesterday, and will take another offloading to reduce cost and risk (considering I really have a negative margin of safety on this stock)

3. I took some more exposure in IGL & BHARTIARTL. As I mentioned in my post on these company, I strongly believe in future prospects, and although current price is about 10% higher than my IV calculations, I'm taking some risk in buying a bit higher since I believe that long term growth prospects offset the risk adequately. This is a classic case of buying slightly higher than calculated fair price if you believe that IV will grow in the future, and opportunity cost of investment is justified (more on this topic soon...)

Let's wait more for this rally to unfold, will take some more prudent calls to reduce exposure in opportunities where I don't believe quite strongly and which are more of Graham like opportunities (ALBK, PNB, and CROMPGREAV to reduce risk due to negative MoS), and wait for downhill movement to pick more of BHARTIARTL, IGL and INFY.

On OPTOCIRCUITS, I'll hold further purchase till I get time to analyze it deeper, especially the incremental return on capital and success of acquisitions and goodwill writeoff.

No comments:

Post a Comment