After a lot of mental deliberations, I decided to stay invested in Banking sector, albeit in conservative, PSU banks. Here is my analysis of second largest PSU bank of India, and one of the well known - Punjab National Bank.

I believe strongly that PNB will sail through this period of turmoil and Mr. Market will rerate this stock and again have it trading at loafty valuations, and that's when I'll say goodbye, and wait patiently for PNB to be dumped again. PSU banks I treat like stalwarts - in bad times, Mr. Market makes them available for dirt cheap prices, and in good times, due to their strong weightage in Index and general bullishness about them, they trade at loafty valuations. Hence, they can generate decent returns between periods of distress and euphoria.

As explained in the calculations above, I'm still comfortable to buy PNB below Rs 800, but it might again trade even lower. However, since I'm already invested over 12% of my portfolio in PNB, I'll not buy any further unless I have balanced my portfolio. Yes, if market euphoria continues, I'll start selling PNB stock when it goes above Rs 1000 - 1100.

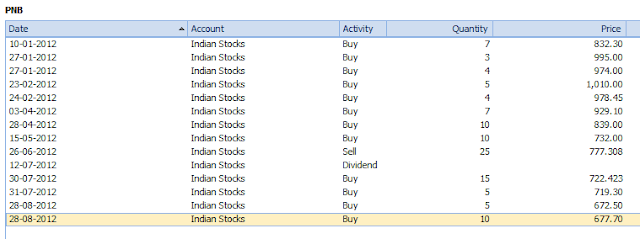

Here're my purchases. Yes, I made a big mistake of valuating BFSI stocks based on EPS and DCF earlier during the year, but then realized the mistake and settled down to more conservative methods. There're many "bad" trades here, like buying high when market was moving high in Jan / Feb, and then not being sure and exiting major stake in BFSI in June, but then I came back after analysis.

No comments:

Post a Comment