Based on my analysis in earlier posts, I plan to make further investment actions as below, in coming weeks and months:

1. Reduce exposure in ALBK and CROMPGREAV by upto 30% of my current investment as the prices increase further. For ALBK, I'll start selling above 160, while for CROMPGREAV, I'll start selling above Rs 145. The rationale is to reduce exposure in businesses where I don't have a very strong confidence or the ones which I've purchased quite expensive.

2. Increase stake in BHARTIARTL, IGL and OPTOCIRCUITS. I'll purchase them below Rs 260, Rs 245 and Rs 127 respectively, and bring their contribution to portfolio to about 10% from current level of 7-8%

3. If INFY crashes again post next quarterly results due in October mid, I'll add more position at below Rs 2300.

Let's see, how things unfold :-) But I'll keep tight control on my irrational emotions to deviate from the plan, and this journal will hopefully help me :-)

Prudential Investing - A Blog about personal finance, value investing & sustainable economics

Sunday, September 30, 2012

Opto Circuits

Good business, but possibly controversial management of funds in acquisitions. A lot of good discussion has happened here. I initially liked the stock, performed some analysis, but then was confused by the fact that I don't understand the products that OCIL makes. So, I bought and then sold within a day.

But then, I realized that I understand the market in which they play. Unfortunately, people are ignorant of their health and hence fall prey to so many heart problems, and this is where OCIL and alike make money.

Here's my reasons to invest in this business:

1. Get exposure to medical industry

2. I believe that OCIL is just into few quarters trouble.

3. Yes, some bad acquisitions, but then some of them are good and have paid as well.

4. Nearly the right price for owning the stock. Slightly more expensive than a conservative IV calculation, but I'm comfortable buying it below Rs 130.

Again, a high growth potential business, but I'll only consider keeping it for decades if management starts doing right things...otherwise, I'll sell it in next bull run.

My investment actions in this stock:

But then, I realized that I understand the market in which they play. Unfortunately, people are ignorant of their health and hence fall prey to so many heart problems, and this is where OCIL and alike make money.

Here's my reasons to invest in this business:

1. Get exposure to medical industry

2. I believe that OCIL is just into few quarters trouble.

3. Yes, some bad acquisitions, but then some of them are good and have paid as well.

4. Nearly the right price for owning the stock. Slightly more expensive than a conservative IV calculation, but I'm comfortable buying it below Rs 130.

Again, a high growth potential business, but I'll only consider keeping it for decades if management starts doing right things...otherwise, I'll sell it in next bull run.

My investment actions in this stock:

Bharti Airtel

Yes another popular index stock that's recently being battered to low prices. Here's an analysis on Bharti Airtel by Vishal, and a very good discussion thread in comments section.

My own analysis about future of the business is here. Yes, from an IV calculation point of view, it is still expensive at Rs 238, which is the recent multi-year low. But I strongly believe in the business future when a large number of people will start using data intensive applications and services, and hence I'm comfortable buying Bharti below Rs 260 (yes its probably an anchoring bias considering my average cost being at about Rs 260). Bharti constitutes about 7.7% of my portfolio currently, and when price drops, I'm waiting to increase my exposure to about 12%

Here're my trades and investment actions in Bharti airtel:

This is one stock that I'll hold for many years, even decades, and keep adding more as it falls. Giving a glimpse of my IV calculation:

1. Graham's hidden bond value of Rs 100, certainly not a right metric to value a telecom stock due to huge growth prospects

2. Using historical P/E as a measure, the value is Rs 400

3. Using modified Graham's number, the value comes at Rs 307

4. Using DCF on FCFF, the value is Rs 170

5. Half PEG is again not a right measure for Bharti

This gives a fair price of Rs 219, so Rs 260 is about 20% more expensive, but I'll be comfortable to buy considering the fact that future EPS will increase as business revives from near low levels of profits, and the deployed network infrastructure begins to pay off with 3G and 4G services in future years.

Happy to find a good business that I'll hold for at least a decade :-)

My own analysis about future of the business is here. Yes, from an IV calculation point of view, it is still expensive at Rs 238, which is the recent multi-year low. But I strongly believe in the business future when a large number of people will start using data intensive applications and services, and hence I'm comfortable buying Bharti below Rs 260 (yes its probably an anchoring bias considering my average cost being at about Rs 260). Bharti constitutes about 7.7% of my portfolio currently, and when price drops, I'm waiting to increase my exposure to about 12%

Here're my trades and investment actions in Bharti airtel:

This is one stock that I'll hold for many years, even decades, and keep adding more as it falls. Giving a glimpse of my IV calculation:

1. Graham's hidden bond value of Rs 100, certainly not a right metric to value a telecom stock due to huge growth prospects

2. Using historical P/E as a measure, the value is Rs 400

3. Using modified Graham's number, the value comes at Rs 307

4. Using DCF on FCFF, the value is Rs 170

5. Half PEG is again not a right measure for Bharti

This gives a fair price of Rs 219, so Rs 260 is about 20% more expensive, but I'll be comfortable to buy considering the fact that future EPS will increase as business revives from near low levels of profits, and the deployed network infrastructure begins to pay off with 3G and 4G services in future years.

Happy to find a good business that I'll hold for at least a decade :-)

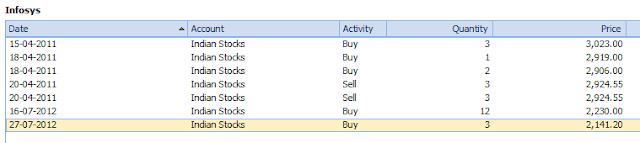

Infosys

Infosys is undoubtedly a very healthy and well managed business in an industry where India excels. I did perform my independent IV calculation, but considering the strong business fundamentals, and the belief I have in the business, I consider this stock as a stalwart opportunity - stable business whose stock gets thrashed due to some one of earning expectations being not met. I purchased it around Rs 2200, and right now it is about 9% in my portfolio and my position stands at ~15% profit.

My IV calculation is here:

1. Infosys is a healthy business with very good ROE, so Graham's hidden bond based valuation will be too conservative a method. It gives a value of Rs 1400, but we'll ignore this method.

2. Since its a major index stock, historical P/E based method is more reasonable, though it is also most unreliable due to market re-rating being unpredictable. This value comes at Rs 2520

3. Modified Graham's number based method gives an IV of Rs 2922

4. DCF on FCFF gives a fair value of Rs 1517

5. Half PEG bargain is again a conservative method - Infosys will almost never trade at bargain P/E multiples due to being a popular, index stock. Hence we ignore this value of Rs 1463.

Accordingly, taking 25% margin of safety, the fair price comes at Rs 1739

Vishal performed this analysis for Infosys. It is a little old I guess, and based on this analysis, my purchase price of Rs 2222 is a good bargain. Hence I'm basing my purchase on Vishal's analysis, since my IV estimates are too conservative, and then I treat Infosys as a stalwart, which I'd sell for 25-40% profits when Mr. Market starts getting euphoric about every stock.

To be frank, i'm a little confused about sell decision here. Yes, if INFY crashes again on quarterly results in mid October, I'll buy more and increase stake to about 12% of my portfolio, but I'm not sure when to sell it. Probably when "dirty IPOs" start coming in market and people rush to buy them...I don't know. Maybe I'll just hold this very good business :-)

Here're my trades and investment actions. Yes, I did "trade" a bit in INFY stock in the past, but now I'm investing with thorough analysis.

My IV calculation is here:

1. Infosys is a healthy business with very good ROE, so Graham's hidden bond based valuation will be too conservative a method. It gives a value of Rs 1400, but we'll ignore this method.

2. Since its a major index stock, historical P/E based method is more reasonable, though it is also most unreliable due to market re-rating being unpredictable. This value comes at Rs 2520

3. Modified Graham's number based method gives an IV of Rs 2922

4. DCF on FCFF gives a fair value of Rs 1517

5. Half PEG bargain is again a conservative method - Infosys will almost never trade at bargain P/E multiples due to being a popular, index stock. Hence we ignore this value of Rs 1463.

Accordingly, taking 25% margin of safety, the fair price comes at Rs 1739

Vishal performed this analysis for Infosys. It is a little old I guess, and based on this analysis, my purchase price of Rs 2222 is a good bargain. Hence I'm basing my purchase on Vishal's analysis, since my IV estimates are too conservative, and then I treat Infosys as a stalwart, which I'd sell for 25-40% profits when Mr. Market starts getting euphoric about every stock.

To be frank, i'm a little confused about sell decision here. Yes, if INFY crashes again on quarterly results in mid October, I'll buy more and increase stake to about 12% of my portfolio, but I'm not sure when to sell it. Probably when "dirty IPOs" start coming in market and people rush to buy them...I don't know. Maybe I'll just hold this very good business :-)

Here're my trades and investment actions. Yes, I did "trade" a bit in INFY stock in the past, but now I'm investing with thorough analysis.

SRF

Here's an interesting small cap company I found while playing with some screens for high dividend yield stocks. I performed the analysis of this stock on SN forum. At current depressed prices around Rs 220, its a very good bargain considering an intrinsic value of Rs 288 with 40% margin of safety. Not to forget that its trading near a multi-year low, and gives 7% tax free dividend income :-)

Here're my purchases in SRF:

I plan to hold this stable, healthy business for long term, enjoy the dividend and keep evaluating business health and change my stance accordingly, in future, if need be.

Here're my purchases in SRF:

I plan to hold this stable, healthy business for long term, enjoy the dividend and keep evaluating business health and change my stance accordingly, in future, if need be.

Manganese Ore India Limited

MOIL is a healthy PSU company, with decent management skills, clean balance sheet, lot of surplus cash to take on good acquisition opportunities. Yes, due to the commodity nature of business, there has been few bad quarters as Manganese prices have come down sharply, but in last 2 quarters, there're indications of prices bottoming out. Let's see how MOIL stock is valued:

1. We won't use PEG bargain method, since MOIL is a slow grower, and hence P/E ratio is not a very good indicator for MOIL.

2. Since its a stable, debt free business, Graham's hidden bond value method is a good indicator and the value comes at Rs 311

3. Using modified Graham's number (not just P/E, but also P/B), the value comes at Rs 321

4. Using DCF of average FCFF of Rs 23, the value comes at Rs 300 per share

With 30% margin of safety, the fair price comes at about Rs 220, which is incidentally also the all time low for the stock.

After making a big mistake of IPO investing in MOIL during 2010-2011 bull run, I started purchasing somewhat higher, again when I did not perform a lot of valuation analysis, and my average cost now is Rs 251 and MOIL constitutes 11% in my portfolio. Here're the investment actions over past 9 months:

I plan to hold this stock for long periods. At least I can say its a safe stock in my portfolio, and will sell it during market euphoria if it becomes too expensive compared to rational valuation.

1. We won't use PEG bargain method, since MOIL is a slow grower, and hence P/E ratio is not a very good indicator for MOIL.

2. Since its a stable, debt free business, Graham's hidden bond value method is a good indicator and the value comes at Rs 311

3. Using modified Graham's number (not just P/E, but also P/B), the value comes at Rs 321

4. Using DCF of average FCFF of Rs 23, the value comes at Rs 300 per share

With 30% margin of safety, the fair price comes at about Rs 220, which is incidentally also the all time low for the stock.

After making a big mistake of IPO investing in MOIL during 2010-2011 bull run, I started purchasing somewhat higher, again when I did not perform a lot of valuation analysis, and my average cost now is Rs 251 and MOIL constitutes 11% in my portfolio. Here're the investment actions over past 9 months:

I plan to hold this stock for long periods. At least I can say its a safe stock in my portfolio, and will sell it during market euphoria if it becomes too expensive compared to rational valuation.

Allahabad Bank

This is more of a Graham style investment. Using a similar method as valuating PNB, and after repeating similar mistakes as I committed in PNB, I've made sizable investment in ALBK, with the expectation for it to rise back again during Euphoria. My average cost now is Rs 139, and I plan to take profits and exit this stock completely when it rises above Rs 175 - 200, primarily because I don't believe very strongly in the business strengths, rather only the fact that it is a very good bargain below Rs 130 and can come back to Rs 200 when "good times" come back.

Here're my investment actions in ALBK:

Here're my investment actions in ALBK:

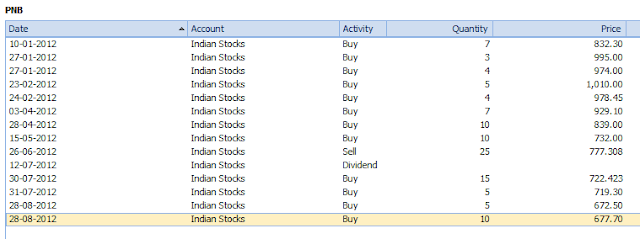

Punjab National Bank

After a lot of mental deliberations, I decided to stay invested in Banking sector, albeit in conservative, PSU banks. Here is my analysis of second largest PSU bank of India, and one of the well known - Punjab National Bank.

I believe strongly that PNB will sail through this period of turmoil and Mr. Market will rerate this stock and again have it trading at loafty valuations, and that's when I'll say goodbye, and wait patiently for PNB to be dumped again. PSU banks I treat like stalwarts - in bad times, Mr. Market makes them available for dirt cheap prices, and in good times, due to their strong weightage in Index and general bullishness about them, they trade at loafty valuations. Hence, they can generate decent returns between periods of distress and euphoria.

As explained in the calculations above, I'm still comfortable to buy PNB below Rs 800, but it might again trade even lower. However, since I'm already invested over 12% of my portfolio in PNB, I'll not buy any further unless I have balanced my portfolio. Yes, if market euphoria continues, I'll start selling PNB stock when it goes above Rs 1000 - 1100.

Here're my purchases. Yes, I made a big mistake of valuating BFSI stocks based on EPS and DCF earlier during the year, but then realized the mistake and settled down to more conservative methods. There're many "bad" trades here, like buying high when market was moving high in Jan / Feb, and then not being sure and exiting major stake in BFSI in June, but then I came back after analysis.

I believe strongly that PNB will sail through this period of turmoil and Mr. Market will rerate this stock and again have it trading at loafty valuations, and that's when I'll say goodbye, and wait patiently for PNB to be dumped again. PSU banks I treat like stalwarts - in bad times, Mr. Market makes them available for dirt cheap prices, and in good times, due to their strong weightage in Index and general bullishness about them, they trade at loafty valuations. Hence, they can generate decent returns between periods of distress and euphoria.

As explained in the calculations above, I'm still comfortable to buy PNB below Rs 800, but it might again trade even lower. However, since I'm already invested over 12% of my portfolio in PNB, I'll not buy any further unless I have balanced my portfolio. Yes, if market euphoria continues, I'll start selling PNB stock when it goes above Rs 1000 - 1100.

Here're my purchases. Yes, I made a big mistake of valuating BFSI stocks based on EPS and DCF earlier during the year, but then realized the mistake and settled down to more conservative methods. There're many "bad" trades here, like buying high when market was moving high in Jan / Feb, and then not being sure and exiting major stake in BFSI in June, but then I came back after analysis.

Saturday, September 29, 2012

Indraprastha Gas Limited

There has been a very good discussion about IGL on Safal Niveshak forum. I personally have seen this company grow in Delhi NCR region in last 10 years, and strongly believe in the future of the business. Yes, it might be my bias, but then I'm trying to be rational and trying to wait until the price comes down below my fair price as i calculate.

Here's my IV calculation for IGL:

1. Graham's Hidden bond value of Rs 132 per share

2. Historical P/E based value of Rs 190

3. Graham's modified number based value of Rs 261

4. Earning Power Value of Rs 230 taking Rs 30 per share of 3 year average FCFF and 2% perpetual growth rate

5. Half PEG bargain value of Rs 200 a share taking 18% growth rate from past 5 years

Let's take a margin of safety of 30%. Then, if we take into account all the above valuations, fair price comes at Rs 142. However, considering that IGL is a fast growing company with huge prospects, I'd not give much weight-age to Graham's Hidden Bond value. Then, the fair price rises up to Rs 155

Now, IGL stock has formed a very strong base at about Rs 230 after dipping sharply to Rs 200 on news of pricing regulations. Considering new changes in LPG subsidy, etc, I believe that the stock will trade higher from here on, and possibly again revert back to Rs 350+ prices.

Yes it might be my bias again, but I've started buying in small quantities at current price of Rs 260 or so. Yes, small quantities, and I'm trying hard to wait for this rally to collapse and general prices to come down and IGL trade again at sub Rs 240 levels.

Here's my purchase so far. Yes, I "traded" IGL in the past. I really wished I bought major quantities at Rs 100 in 2008 :-(

Here's my IV calculation for IGL:

1. Graham's Hidden bond value of Rs 132 per share

2. Historical P/E based value of Rs 190

3. Graham's modified number based value of Rs 261

4. Earning Power Value of Rs 230 taking Rs 30 per share of 3 year average FCFF and 2% perpetual growth rate

5. Half PEG bargain value of Rs 200 a share taking 18% growth rate from past 5 years

Let's take a margin of safety of 30%. Then, if we take into account all the above valuations, fair price comes at Rs 142. However, considering that IGL is a fast growing company with huge prospects, I'd not give much weight-age to Graham's Hidden Bond value. Then, the fair price rises up to Rs 155

Now, IGL stock has formed a very strong base at about Rs 230 after dipping sharply to Rs 200 on news of pricing regulations. Considering new changes in LPG subsidy, etc, I believe that the stock will trade higher from here on, and possibly again revert back to Rs 350+ prices.

Yes it might be my bias again, but I've started buying in small quantities at current price of Rs 260 or so. Yes, small quantities, and I'm trying hard to wait for this rally to collapse and general prices to come down and IGL trade again at sub Rs 240 levels.

Here's my purchase so far. Yes, I "traded" IGL in the past. I really wished I bought major quantities at Rs 100 in 2008 :-(

Crompton Greaves

Crompton Greaves is a decently well known name for mid sized electrical equipment like transformers, motors, etc. The company has shown consistent growth in last 10 years since it started expanding outside India. Yes, there have been some bad acquisitions, but still on average a good performance across the board.

Here's the IV calculation:

1. Graham's Hidden Bond Value of Rs 69

2. Historical P/E based balue of Rs 115

3. Modified Graham's Number based value of Rs 122

4. There has been a sharp decline in EPS for last few quarters owing to slowdown across the globe, and hence a depressed Earning Power Value (assuming 2% growth in future) of Rs 48

5. Half PEG fair value of Rs 48, taking part 5 years growth rate of 8%.

Assuming 30% Margin of Safety, the fair price comes at Rs 56. However, this is quite depressed a value due to recent performance being hampered due to slowdown, but we expect this will improve to a good extent in future, and considering the huge potential in India for infrastructure development, the market conditions will considerably improve in future.

However, I admit that my purchase price of Rs 129 has been quite high for Crompton Greaves, and there's risk of further fall in prices. Moreover, Crompton Greaves is 12.3% of my portfolio (its concentrated, 10 stocks in total, top 4 stocks constitute 50% and top 6 constitute 75%, and the primary reason is that I believe I can't manage more than 10 stock portfolio...) at current market prices.

However, I believe in the business model and capabilities of the management, and most importantly, in the irrational behaviour of Mr. Market participants, and the fact that I have time with me. I'll slowly reduce my exposure during the next bull phase of market and when everything starts rising as if it were the best investment.

Here's the history of my trades in Crompton Greaves stock. Yes, I've bought at high prices when I was euphoric that I know so much, when i actually did not!

Here's the IV calculation:

1. Graham's Hidden Bond Value of Rs 69

2. Historical P/E based balue of Rs 115

3. Modified Graham's Number based value of Rs 122

4. There has been a sharp decline in EPS for last few quarters owing to slowdown across the globe, and hence a depressed Earning Power Value (assuming 2% growth in future) of Rs 48

5. Half PEG fair value of Rs 48, taking part 5 years growth rate of 8%.

Assuming 30% Margin of Safety, the fair price comes at Rs 56. However, this is quite depressed a value due to recent performance being hampered due to slowdown, but we expect this will improve to a good extent in future, and considering the huge potential in India for infrastructure development, the market conditions will considerably improve in future.

However, I admit that my purchase price of Rs 129 has been quite high for Crompton Greaves, and there's risk of further fall in prices. Moreover, Crompton Greaves is 12.3% of my portfolio (its concentrated, 10 stocks in total, top 4 stocks constitute 50% and top 6 constitute 75%, and the primary reason is that I believe I can't manage more than 10 stock portfolio...) at current market prices.

However, I believe in the business model and capabilities of the management, and most importantly, in the irrational behaviour of Mr. Market participants, and the fact that I have time with me. I'll slowly reduce my exposure during the next bull phase of market and when everything starts rising as if it were the best investment.

Here's the history of my trades in Crompton Greaves stock. Yes, I've bought at high prices when I was euphoric that I know so much, when i actually did not!

Bharat Heavy Electricals Limited

Here's a very nice analysis of this well known PSU company.

My analysis about BHEL tells that it'll remain to be a healthy and growing company, and it still has huge potential given the fact that India still needs a huge capacity expansion in power infrastructure space. Since BHEL is a PSU company, and known for its quality of products, it'll continue to enjoy the status of preferred suppliers for many large PSU power generation companies like NTPC, etc.

My independent Intrinsic Valuation tells the following:

1. Graham's hidden bond value of Rs 188 per share

2. Historical P/E and average EPS based value of Rs 460 per share

3. Average P/B and P/E based modified Graham's number gives a value of Rs 423

4. Earning power value, assuming a constant growth rate of 2% YoY in future earnings, and using last 3 years' FCFF gives a value of Rs 167

5. Half PEG based bargain value of Rs 377, given 24% CAGR in last 5 years EPS

Effectively, with 30% Margin of safety, the fair purchase price for BHEL stock comes at Rs 226. My average purchase price is Rs 220 and BHEL is currently about 15% of my concentrated portfolio (note that cost vise its lesser, but due to recent rally and current price of Rs 250, the contribution of BHEL in my portfolio has increased).

I've been purchasing BHEL since the beginning of 2012. I entered at higher prices while I was still learning, realized the mistake and exited at cost, and then analyzed and entered again when the stock was getting battered. Here is my journal of investing in BHEL:

When will I sell the shares of BHEL? Well, not until I see the business deteriorating, and I'll continue to hold or even increase my exposure when I have more cash to invest. For now, at least for next one year when I'll re-analyze the business, its time to just hold and enjoy the dividend income :-)

My analysis about BHEL tells that it'll remain to be a healthy and growing company, and it still has huge potential given the fact that India still needs a huge capacity expansion in power infrastructure space. Since BHEL is a PSU company, and known for its quality of products, it'll continue to enjoy the status of preferred suppliers for many large PSU power generation companies like NTPC, etc.

My independent Intrinsic Valuation tells the following:

1. Graham's hidden bond value of Rs 188 per share

2. Historical P/E and average EPS based value of Rs 460 per share

3. Average P/B and P/E based modified Graham's number gives a value of Rs 423

4. Earning power value, assuming a constant growth rate of 2% YoY in future earnings, and using last 3 years' FCFF gives a value of Rs 167

5. Half PEG based bargain value of Rs 377, given 24% CAGR in last 5 years EPS

Effectively, with 30% Margin of safety, the fair purchase price for BHEL stock comes at Rs 226. My average purchase price is Rs 220 and BHEL is currently about 15% of my concentrated portfolio (note that cost vise its lesser, but due to recent rally and current price of Rs 250, the contribution of BHEL in my portfolio has increased).

I've been purchasing BHEL since the beginning of 2012. I entered at higher prices while I was still learning, realized the mistake and exited at cost, and then analyzed and entered again when the stock was getting battered. Here is my journal of investing in BHEL:

When will I sell the shares of BHEL? Well, not until I see the business deteriorating, and I'll continue to hold or even increase my exposure when I have more cash to invest. For now, at least for next one year when I'll re-analyze the business, its time to just hold and enjoy the dividend income :-)

Welcome

Hello Friends

This is the first post on PruFolio blog, and we start simple. As we learn value investing and we practice its principles, the first step is to log the investment decisions and hence I start on this blog by creating a live investment journal.

As of today, I hold the following portfolio:

From the next post onwards, I'll write down my rationale to invest in these stocks, the right and wrong decisions during last 9 months, and the current action plan

This is the first post on PruFolio blog, and we start simple. As we learn value investing and we practice its principles, the first step is to log the investment decisions and hence I start on this blog by creating a live investment journal.

As of today, I hold the following portfolio:

From the next post onwards, I'll write down my rationale to invest in these stocks, the right and wrong decisions during last 9 months, and the current action plan

Subscribe to:

Comments (Atom)