In the last post, I analyzed my stock portfolio holdings and said that I'm confused about SRF, MAZDA and IGL.

I took some time to analyze these further, starting with MAZDA, and here's what I find:

- Another independent research on this business:

http://valueinvestinginpractice.blogspot.in/2012/04/mazda-limited-engineering-value-play.html

Good analysis, pros and cons and I more or less agree and would do the same...

- Management compensation. While it is high in percentage terms (15% of net profit), looking at the history, for last 5 years, the three executive directors' salaries have been around Rs 30 lacs each, and occasional bonus / commission. This is still high in percentage terms, but reasonable in absolute terms considering the performance they've generated - consistent OPM and NPM of 15% and 10% roughly, and an ROE of 18%+ (except this year) with nearly zero debt

- Custom engineering business means lesser competition and hence lower risk of profit margin erosion.

- Crolles technical collaboration is a plus, with equal risk of losing competetive advantage if terms go bad with crolles.

All in all, this looks a decent business, undervalued substantially and low risk of things going wrong. Hence, even though it is small, I've decided to increase and build up to 5% stake in my portfolio. I've started buying more below Rs 100 (my initial IV calculation was Rs 87, but considering management has bough shares from market at that price, its unlikely prices will come down to Rs 87 soon, and I'm only buying it about 10% higher than my target.

Next is on IGL and SRF in another post :-)

Prudential Investing - A Blog about personal finance, value investing & sustainable economics

Thursday, October 18, 2012

Monday, October 15, 2012

Health Check

Over the last 24 hours, quite a few emotional tides, and finally today's post on SN helps me settle down.

I was getting excited about finding these small caps trading so cheap, and added to watchlist, and was even thinking of adding small positions in the following counters:

HALDYN GLASS

NAVIN FLOURINE

PUNEET RESINS

Most likely, all three of above are out of the list already, a big relief :-)

Also thinking about reshuffling betweek SRF and MAZDA.

But before I do anything, I'll step back and analyze my existing positions. Let's start:

Healthy Ones:

BHEL, MOIL, INFY, CROMPGREAV

These are debt free companies, very good ROE of 30%+ over past 5 years, consistent and stable growth and decent valuations, adjusting for market reputation. My purchase prices too are all right, maybe a little expensive, but still quite good compared to historical levels. I'll be very comfortable to hold them and not be worried due to transient down quarters and slowdown in growth.

Cautious One:

BHARTIARTL, OPTOCIRCUIT

Good, promising businesses, but concerns of declining margins for Bharti, while cash flow concerns for Opto Circuits. Since I believe in long term prospects of the businesses, and the fact that they're available at deep discounts, I'll still hold them, but yes, I understand the risk is higher in these investments, but then rewards are equally good.

Comfortable, but exit on rise:

PNB is one stock where I believe its decent, but not a stock I'll hold for long term. Its more of a positional stock - buy when it crashes below Rs 680, and sell when it goes above Rs. 900. But never increase beyond 7% of portfolio.

Confused:

SRF, MAZDA and IGL.

For IGL, I believe in story, but then, concerns that its a little more expensive, and risk of further margin contraction due to PNGRB decisions. Right now, have invested 3% of portfolio in IGL, but given the discovery of new potentially better opportunities, will need to re-think before making further purchase.

For SRF, the new concern about "small caps being value trap" is on my mind, and if I do conservative analysis, I find cyclical profit margin contraction (is it really cyclical?), increasing debt, and some other concerns I've posted today. I'll analyze more and see if I should take some profits off, if not a complete exit.

MAZDA, looks good, but need to do a critical analysis and make sure chances of this turning as a value trap are minimal, and only then I'll add more positions. In any case, I'm not comfortable having more than 15% of my portfolio in small caps, so i I have to add positions, it'll only be when I'm convinced it is better than SRF.

Excited!!!

Piramal Enterprises. Every time I look at it, I'm more convinced its a great opportunity. Yes, it might not rebound fast, but given Mr. Piramal's skills, I consider this as a stock to hold for long term. I've added about 1.4% of my portfolio in PEL stock, and will add below Rs 470.

Finally, there're few more stocks in my watchlist which I need to analyze. I'll probably wait for while, let excitement stabilize and then take a decision - whether to freeze my portfolio (except only exiting stocks on rise where I'm not very comfortable or want to exit at a certain price) and spend time studying and reading long pending list of items, or to continue this churn. Certainly, considering short term financial obligations coming my way, the former choice looks better. Not that I'm underinvested, even if I clean up and freeze, I'll still have 50%+ of my investments in equity, so not a bad figure and not a risk of missing the next boom, if it has started :-)

Let's sleep and relax, its a great way to control irrational exuberance.

I was getting excited about finding these small caps trading so cheap, and added to watchlist, and was even thinking of adding small positions in the following counters:

HALDYN GLASS

NAVIN FLOURINE

PUNEET RESINS

Most likely, all three of above are out of the list already, a big relief :-)

Also thinking about reshuffling betweek SRF and MAZDA.

But before I do anything, I'll step back and analyze my existing positions. Let's start:

Healthy Ones:

BHEL, MOIL, INFY, CROMPGREAV

These are debt free companies, very good ROE of 30%+ over past 5 years, consistent and stable growth and decent valuations, adjusting for market reputation. My purchase prices too are all right, maybe a little expensive, but still quite good compared to historical levels. I'll be very comfortable to hold them and not be worried due to transient down quarters and slowdown in growth.

Cautious One:

BHARTIARTL, OPTOCIRCUIT

Good, promising businesses, but concerns of declining margins for Bharti, while cash flow concerns for Opto Circuits. Since I believe in long term prospects of the businesses, and the fact that they're available at deep discounts, I'll still hold them, but yes, I understand the risk is higher in these investments, but then rewards are equally good.

Comfortable, but exit on rise:

PNB is one stock where I believe its decent, but not a stock I'll hold for long term. Its more of a positional stock - buy when it crashes below Rs 680, and sell when it goes above Rs. 900. But never increase beyond 7% of portfolio.

Confused:

SRF, MAZDA and IGL.

For IGL, I believe in story, but then, concerns that its a little more expensive, and risk of further margin contraction due to PNGRB decisions. Right now, have invested 3% of portfolio in IGL, but given the discovery of new potentially better opportunities, will need to re-think before making further purchase.

For SRF, the new concern about "small caps being value trap" is on my mind, and if I do conservative analysis, I find cyclical profit margin contraction (is it really cyclical?), increasing debt, and some other concerns I've posted today. I'll analyze more and see if I should take some profits off, if not a complete exit.

MAZDA, looks good, but need to do a critical analysis and make sure chances of this turning as a value trap are minimal, and only then I'll add more positions. In any case, I'm not comfortable having more than 15% of my portfolio in small caps, so i I have to add positions, it'll only be when I'm convinced it is better than SRF.

Excited!!!

Piramal Enterprises. Every time I look at it, I'm more convinced its a great opportunity. Yes, it might not rebound fast, but given Mr. Piramal's skills, I consider this as a stock to hold for long term. I've added about 1.4% of my portfolio in PEL stock, and will add below Rs 470.

Finally, there're few more stocks in my watchlist which I need to analyze. I'll probably wait for while, let excitement stabilize and then take a decision - whether to freeze my portfolio (except only exiting stocks on rise where I'm not very comfortable or want to exit at a certain price) and spend time studying and reading long pending list of items, or to continue this churn. Certainly, considering short term financial obligations coming my way, the former choice looks better. Not that I'm underinvested, even if I clean up and freeze, I'll still have 50%+ of my investments in equity, so not a bad figure and not a risk of missing the next boom, if it has started :-)

Let's sleep and relax, its a great way to control irrational exuberance.

Saturday, October 13, 2012

Re-allocation

I purchased some more Infosys when it crashed 8% yesterday after results, at Rs 2345. Rs 15 will be returned back in a month as dividend, so if I assume I reinvested dividend on my total stake in INFY, my incremental cost is Rs 2267, and my new average cost being Rs 2250.

I also completed my purchase in OPTO CIRCUITS, for a total average cost of Rs 129 and ~10% stake in portfolio.

I also decide that Piramal Enterprises is a far better opportunity than MAZDA, and I'm still not comfortable to put my stake in a small cap company compared to an excellent sidecar opportunity. Hence, I'll exit the small tracking position I took in MAZDA and start putting more money in PEL, the cash generated from sale of ALBK and PNB...

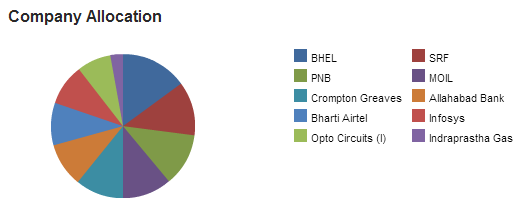

Here'e the new portfolio composition:

The balancing is happening now...only IGL and PEL need to get more stake, while others are fixed now. PNB, well, if it drops back to Rs 660, I'll consider buying, and will exit above Rs 1000 or so...

I also completed my purchase in OPTO CIRCUITS, for a total average cost of Rs 129 and ~10% stake in portfolio.

I also decide that Piramal Enterprises is a far better opportunity than MAZDA, and I'm still not comfortable to put my stake in a small cap company compared to an excellent sidecar opportunity. Hence, I'll exit the small tracking position I took in MAZDA and start putting more money in PEL, the cash generated from sale of ALBK and PNB...

Here'e the new portfolio composition:

The balancing is happening now...only IGL and PEL need to get more stake, while others are fixed now. PNB, well, if it drops back to Rs 660, I'll consider buying, and will exit above Rs 1000 or so...

Piramal Enterprises

As I wrote 2 days back, today I perform the detailed analysis of Piramal Industries, earlier known as Piramal Healthcare.

Let me first write my reasons to research this stock, they'll help remove some biases:

1. Its been discussed few times in value investing forums.

2. Prof. Sanjay Bakshi analyzed it an year back and found it attractive, the price has not moved yet and there're more reasons for the business to be more attractive than an year back.

3. Mr. Ajay Piramal is known for his superb capital allocation skills, and I think he can make better use of my money than I can do.

4. PEL now owns 11% stake in Vodafone India. Below I analyze if this stake is undervalued in PEL stock.

Ok, so, first step in valuation of PEL is to find a value for Vodafone India. Vodafone India has about 16.4% market share of Indian telecom (cellular, GSM) market, which currently stands at about 911 million subscribers, according to a report by TRAI. Since Bharti Airtel, the largest subscriber owns 19.62% market share, a reasonable estimate of Vodafone's revenue is 16.4/19.6 * 416038 million = ~Rs 350000 million for year 2011-12. Taking an average Net Profit Margin of 20% for the industry, we can arrive at Earning for Vodafone as Rs 70000 million for year 2011-12. Now, under current distressed industry situation, Bharti trades at 17P/E, and it won't be unreasonable to assume that if Vodafone India were public it'll trade at least at 15 times its earnings. This gives a total market cap of Rs 105000 crores to Vodafone India, of which, PEL owns 11%.

Thus, the market value estimate for the stake in Vodafone India alone is Rs 10500 crores. Taking a margin of safety of 40% on this calculation, we can at least assume Rs 6000, which is what is roughly PEL paid to acquire the stake. So, this gives a good confident that book value of vodafone stake in PEL is at least slightly undervalued, and Mr. Piramal has struck a good deal.

So, net of Vodafone Investments + Cash - Long term Debt is Rs 300 per share (6000 cr + 57 cr - 892 cr = 5150 cr = 46% of book value) = Rs 300 roughly, and there's a lot of margin due to Vodafone valuation with 40% discount.

The question now is, at current price of Rs 470, what else within the business makes it still undervalued compared to rest of Rs 170 per share price. Let's try to analyze:

DRG Acquisition

Referring to Analysts presentation, DRG is a healthy business, with high barrier to entry, negative working capital, consistent 20%+ revenue growth and even high profit growth, debt free, diversified client portfolio, and PEL has acquired it for $635M, when DRG is expected to have a revenue of $160M in FY2012. This is 4X revenue valuation, in line with market valuations for such businesses in US.

Assuming current profit of 20%+, earnings for FY2012 are expected to be about $35M. Assuming 2 stage DCF, with 18% growth in FCFF for next 8 years and 2% thereafter, we arrive at a fair value of $650M, very close to what PEL paid. Thus the value of DRG in each share of PEL is about Rs 180.

Due to bridged acquisition over 18 months, starting May 2012, with 1:1 payment through equity and debt, and debt being at 5.5% cost. They plan to raise debt against DRG asset itself in US. Can we count the value of DRG today? There'll be increase in debt upto an amount of $320M on books of DRG, which can be easily serviced (interest cost will be $17.5M per year). Even if debt is carried on books of PEL, it can be easily serviced from available cash (or potential cash inflow from dividends that might be generated from DRG profits). The equity part will be paid out of cash inflow to come from Abbott over next 3 years ($1.2B) and from sale of Vodafone stake, which they say is a short term investment. Hence, we should NOT add Rs 180 into value for PEL, maybe something between Rs 90 and 180.

Before we move forward, let's stop and revise and tally. Sale to Abbott would generate a total cash inflow of $2.2B as one time, received in 2010, and then, $400M annually from 2011 to 2014. Till now, $2.2B + $400M is received and is on books ending FY2011-12. ll this total amount is sufficient to cover purchase of Vodafone and DRG and still leave surplus cash, so debt arising from DRG should not worry us, but as a conservatism, let's account for only 70% of Rs 180 from DRG, and hence total value accounted is now rs 300 due to Vodafone and Rs 125 due to DRG. This leaves Rs 45 more to be accounted, NOT counting any surplus cash inflow remaining from Abbott by 2014.

Pls note that we've been very conservative in valuing Vodafone and DRG so far, and yet only left behind with Rs 45 to be accounted for remaining businesses that PEL holds.

Financial Subsidaries

Let's start with the INDIAREIT Fund advisors and Investment Management compaty, along with PHL finance pvt ltd. These were acquired for a total consideration of Rs 225 cr, summing to Rs 11.63, net's knock off Rs 10 as the value from remaining Rs 45. Sime reason being a belief in Mr. Piramal's value investing skills, he won't pay more that value, and then we can say Rs 10 per share of PEL is a good value for these INDIAREIT companies.

Let us also not count any further value for other financial subsidaries.

Now remains Rs 35. Sales from all the Pharma and Healthcare related businesses (accounting for over 80% of total consolidated sales) was Rs 1988 cr in FY2011-12. Average profit margin is 16%+, and this means a total Operating Profit - Depreciation (EBIT) of over Rs 318 - Rs 140 cr or equivalently, Rs 180 cr = Rs 10.5 per share.

This gives a debt capacity of Rs 10.5 / 3 / 0.09 = Rs 39 per share for healthcare related business. This means, that if we leave aside Vodafone and DRG and financial acquisitions at cost (and believe in Mr Piramal's skills to equate purchase price as fair value), the remaining business, in current state is available at Debt Capacity!

Can you buy a pharma business today at debt capacity? Not really, all pharma businesses enjoy high valuations, owing to stability of their business fundamentals. Hence, I believe Piramal Enterprises is still quite undervalued and I can enter below Rs 470 a share quite comfortably. Of course, it'd make sense to stagger the buying, so I'll now start increasing my stake in PEL gradually, buying on dips below Rs 470, upto 10% of my portfolio.

The belief is in excellent skills of capital allocation of Mr. Piramal, and the fact that he's driving the enterprise to be in the right businesses in pharma world, and building a portfolio of right verticals. I still need to read in details the analysis Prof. Bakshi did 17 months back, but now I won't be biased - I have performed my analysis and can make it more pruned by reading what the revered professor has to say.

Another sidecar investment. Its good to analyze sidecar opportunities and invest while you're still learning to do independent research :-)

Here I come Piramal Enterprises...and next post will tell the new action plan.

-----------------------------------------------------------------------------

Here's a structured calculation of IV to find at what margin of safety is the stock trading right now.

1. Valuation of Vodafone stake is Rs 10500 cr.

2. Valuation of DRG stake is NOT counted, since it is yet to come on books. instead, we count the cash inflow of 3 x $400M = $1.2B = Rs 6000 cr (@ 50$ - INR = 50). Let's be double conservative and consider only upto 70% will go to good use (this also discounts future cash flows), and hence, effective value comes at Rs 4000 cr.

3. We found that debt capacity for all pharma related business is about Rs 667 cr. Taking Graham's minimum value of common stock as 1.75X of debt capacity, we can assume a value for Rs 1160 cr. for pharma business.

4. Finally, we reduce total liabilities of Rs 2600 cr.

Ignoring other businesses, we find the value for Piramal Industries as Rs 10500 + 4000 + 1160 - 2600 = Rs 13000+ cr. This translates to Rs. 680 per share. Since a good part of this is cash, which will be paid to buy DRG, we should still take some decent margin of safety.

At CMP, we're getting this company at 30% margin of safty. I think it's a decent margin of safety for such a well managed enterprise, in hands of an excellent investor. I'll be doubly confident to buy this stock now :-)

Let me first write my reasons to research this stock, they'll help remove some biases:

1. Its been discussed few times in value investing forums.

2. Prof. Sanjay Bakshi analyzed it an year back and found it attractive, the price has not moved yet and there're more reasons for the business to be more attractive than an year back.

3. Mr. Ajay Piramal is known for his superb capital allocation skills, and I think he can make better use of my money than I can do.

4. PEL now owns 11% stake in Vodafone India. Below I analyze if this stake is undervalued in PEL stock.

Ok, so, first step in valuation of PEL is to find a value for Vodafone India. Vodafone India has about 16.4% market share of Indian telecom (cellular, GSM) market, which currently stands at about 911 million subscribers, according to a report by TRAI. Since Bharti Airtel, the largest subscriber owns 19.62% market share, a reasonable estimate of Vodafone's revenue is 16.4/19.6 * 416038 million = ~Rs 350000 million for year 2011-12. Taking an average Net Profit Margin of 20% for the industry, we can arrive at Earning for Vodafone as Rs 70000 million for year 2011-12. Now, under current distressed industry situation, Bharti trades at 17P/E, and it won't be unreasonable to assume that if Vodafone India were public it'll trade at least at 15 times its earnings. This gives a total market cap of Rs 105000 crores to Vodafone India, of which, PEL owns 11%.

Thus, the market value estimate for the stake in Vodafone India alone is Rs 10500 crores. Taking a margin of safety of 40% on this calculation, we can at least assume Rs 6000, which is what is roughly PEL paid to acquire the stake. So, this gives a good confident that book value of vodafone stake in PEL is at least slightly undervalued, and Mr. Piramal has struck a good deal.

So, net of Vodafone Investments + Cash - Long term Debt is Rs 300 per share (6000 cr + 57 cr - 892 cr = 5150 cr = 46% of book value) = Rs 300 roughly, and there's a lot of margin due to Vodafone valuation with 40% discount.

The question now is, at current price of Rs 470, what else within the business makes it still undervalued compared to rest of Rs 170 per share price. Let's try to analyze:

DRG Acquisition

Referring to Analysts presentation, DRG is a healthy business, with high barrier to entry, negative working capital, consistent 20%+ revenue growth and even high profit growth, debt free, diversified client portfolio, and PEL has acquired it for $635M, when DRG is expected to have a revenue of $160M in FY2012. This is 4X revenue valuation, in line with market valuations for such businesses in US.

Assuming current profit of 20%+, earnings for FY2012 are expected to be about $35M. Assuming 2 stage DCF, with 18% growth in FCFF for next 8 years and 2% thereafter, we arrive at a fair value of $650M, very close to what PEL paid. Thus the value of DRG in each share of PEL is about Rs 180.

Due to bridged acquisition over 18 months, starting May 2012, with 1:1 payment through equity and debt, and debt being at 5.5% cost. They plan to raise debt against DRG asset itself in US. Can we count the value of DRG today? There'll be increase in debt upto an amount of $320M on books of DRG, which can be easily serviced (interest cost will be $17.5M per year). Even if debt is carried on books of PEL, it can be easily serviced from available cash (or potential cash inflow from dividends that might be generated from DRG profits). The equity part will be paid out of cash inflow to come from Abbott over next 3 years ($1.2B) and from sale of Vodafone stake, which they say is a short term investment. Hence, we should NOT add Rs 180 into value for PEL, maybe something between Rs 90 and 180.

Before we move forward, let's stop and revise and tally. Sale to Abbott would generate a total cash inflow of $2.2B as one time, received in 2010, and then, $400M annually from 2011 to 2014. Till now, $2.2B + $400M is received and is on books ending FY2011-12. ll this total amount is sufficient to cover purchase of Vodafone and DRG and still leave surplus cash, so debt arising from DRG should not worry us, but as a conservatism, let's account for only 70% of Rs 180 from DRG, and hence total value accounted is now rs 300 due to Vodafone and Rs 125 due to DRG. This leaves Rs 45 more to be accounted, NOT counting any surplus cash inflow remaining from Abbott by 2014.

Pls note that we've been very conservative in valuing Vodafone and DRG so far, and yet only left behind with Rs 45 to be accounted for remaining businesses that PEL holds.

Financial Subsidaries

Let's start with the INDIAREIT Fund advisors and Investment Management compaty, along with PHL finance pvt ltd. These were acquired for a total consideration of Rs 225 cr, summing to Rs 11.63, net's knock off Rs 10 as the value from remaining Rs 45. Sime reason being a belief in Mr. Piramal's value investing skills, he won't pay more that value, and then we can say Rs 10 per share of PEL is a good value for these INDIAREIT companies.

Let us also not count any further value for other financial subsidaries.

Now remains Rs 35. Sales from all the Pharma and Healthcare related businesses (accounting for over 80% of total consolidated sales) was Rs 1988 cr in FY2011-12. Average profit margin is 16%+, and this means a total Operating Profit - Depreciation (EBIT) of over Rs 318 - Rs 140 cr or equivalently, Rs 180 cr = Rs 10.5 per share.

This gives a debt capacity of Rs 10.5 / 3 / 0.09 = Rs 39 per share for healthcare related business. This means, that if we leave aside Vodafone and DRG and financial acquisitions at cost (and believe in Mr Piramal's skills to equate purchase price as fair value), the remaining business, in current state is available at Debt Capacity!

Can you buy a pharma business today at debt capacity? Not really, all pharma businesses enjoy high valuations, owing to stability of their business fundamentals. Hence, I believe Piramal Enterprises is still quite undervalued and I can enter below Rs 470 a share quite comfortably. Of course, it'd make sense to stagger the buying, so I'll now start increasing my stake in PEL gradually, buying on dips below Rs 470, upto 10% of my portfolio.

The belief is in excellent skills of capital allocation of Mr. Piramal, and the fact that he's driving the enterprise to be in the right businesses in pharma world, and building a portfolio of right verticals. I still need to read in details the analysis Prof. Bakshi did 17 months back, but now I won't be biased - I have performed my analysis and can make it more pruned by reading what the revered professor has to say.

Another sidecar investment. Its good to analyze sidecar opportunities and invest while you're still learning to do independent research :-)

Here I come Piramal Enterprises...and next post will tell the new action plan.

-----------------------------------------------------------------------------

Here's a structured calculation of IV to find at what margin of safety is the stock trading right now.

1. Valuation of Vodafone stake is Rs 10500 cr.

2. Valuation of DRG stake is NOT counted, since it is yet to come on books. instead, we count the cash inflow of 3 x $400M = $1.2B = Rs 6000 cr (@ 50$ - INR = 50). Let's be double conservative and consider only upto 70% will go to good use (this also discounts future cash flows), and hence, effective value comes at Rs 4000 cr.

3. We found that debt capacity for all pharma related business is about Rs 667 cr. Taking Graham's minimum value of common stock as 1.75X of debt capacity, we can assume a value for Rs 1160 cr. for pharma business.

4. Finally, we reduce total liabilities of Rs 2600 cr.

Ignoring other businesses, we find the value for Piramal Industries as Rs 10500 + 4000 + 1160 - 2600 = Rs 13000+ cr. This translates to Rs. 680 per share. Since a good part of this is cash, which will be paid to buy DRG, we should still take some decent margin of safety.

At CMP, we're getting this company at 30% margin of safty. I think it's a decent margin of safety for such a well managed enterprise, in hands of an excellent investor. I'll be doubly confident to buy this stock now :-)

Thursday, October 11, 2012

A new opportunity

Well, this is one stock I've heard quite a few times, and I'm analyzing it these days. Piramal Industries (earlier Healthcare)...yes, interesting company, but still need some time for detailed analysis, so took a tracking position in it.

Since this will now become 11th stock, and I have two small caps, SRF and MAZDA now, I'm thinking about balancing capital betweek SRF and MAZDA, such that the risk of getting into two 'value traps' reduces. The rationale is that while both SRF and MAZDA are healthy businesses, the risk of not getting a higher valuation by market is prevalent due to small company profile, boring business and not so strong moat. So, from current ~14% level of SRF, I plan to bring down level to ~6% and fill MAZDA will the flows. Of course, the key is to way for the right moment to reduce SRF and increase MAZDA. I'll buy more of MAZDA below Rs 87, while reduce SRF when it returns to 230+ levels.

Now that this is a new thought, I should also wait for it to sink it before taking action, so, let's wait for the result reason to begin and see how overall market behaves.

Of course, till then, I'll also analyze Piramal Industries and maybe something changes on this thought...let's wait and watch :-)

Since this will now become 11th stock, and I have two small caps, SRF and MAZDA now, I'm thinking about balancing capital betweek SRF and MAZDA, such that the risk of getting into two 'value traps' reduces. The rationale is that while both SRF and MAZDA are healthy businesses, the risk of not getting a higher valuation by market is prevalent due to small company profile, boring business and not so strong moat. So, from current ~14% level of SRF, I plan to bring down level to ~6% and fill MAZDA will the flows. Of course, the key is to way for the right moment to reduce SRF and increase MAZDA. I'll buy more of MAZDA below Rs 87, while reduce SRF when it returns to 230+ levels.

Now that this is a new thought, I should also wait for it to sink it before taking action, so, let's wait for the result reason to begin and see how overall market behaves.

Of course, till then, I'll also analyze Piramal Industries and maybe something changes on this thought...let's wait and watch :-)

Tuesday, October 09, 2012

Goodbye Allahabad Bank

Well, I was not feeling comfortable holding more than 17% of my portfolio in BFSI stocks, especially after they ran up 25% in last 45 days. Finally, I decided to reduce BFSI to below 10%, and exited ALBK completely, while reduce 33% of PNB holding. Due to bad investments in ALBK in the past, I stand at an all time loss of 3.5% in this stock, but yes, since the last purchase, I've had over 12% profit. Goodbye, when you again get dumped to drain, I'll pick you again...

In PNB also, since I was invested upto my limit of 11% per stocks in portfolio (BHEL is an exception...), and I sense it has also run up beyond my calculated IV, too fast in last 45 days, its prudent to reduce some exposure. Now my total BFSI exposure is 8.2% and only stock being PNB, which I still believe, my current average cost is around 710 (after a net loss to date of about 15% of my current holding.

Since I reduced about 14% invested amount by these actions, I also reallocated some money, and completed purchase in BHARTIARTL to 11%. Yes, I bought it a little expensive, but given the fact that it's making a very strong base around 260 levels, and my conservative IV calculation only gives a 10% lower price, I'm comfortable in buying a good business with healthy prospects at a slightly higher price than my IV. This is a classic example where my conviction in business future prospect is stronger than my confidence in correctness of IV calculation.

Additionally, now that I've 9 stocks, I also have room to add a new stock, and out of my watchlist, MAZDA is one business which I like. There has been some good discussion on SN forum, and its been few weeks that we've waited to assimilate the discussion, and my gut feel says - go ahead. Strong business fundamental, undervalued by a conservative IV calculation method, healthy record of cash flow generation, decent dividend yield, and no debt. Just the right kind of company you'd want to buy in. Yes, Ideally I'd like to buy below Rs 87, but again, giving benefit of doubt in IV calculation, since its only about 12% higher, and started buying in small amounts. As it falls, I've surplus cash from sale of banking stocks to gradually build up exposure in MAZDA. Thanks Sanjeev Ji for analyzing this good stock.

Finally, here's my new portfolio allocation, by stocks:

And this is by sector. Yes, my exposure in Capital goods sector is above 30%, primarily due to good run up in BHEL and the fact that BHEL alone stands at 17% in my portfolio. But I strongly believe in the business prospects, and in long term, both BHEL and CROMPGREAV will deliver - they're healthy businesses, run by able management, and there's a huge potential for both these companies to grow further given the large power infrastructure need in India. Yes, there's competition, but these are good brands which enjoy reputation of quality products, and eventually, quality wins in such mammoth investment spaces.

In PNB also, since I was invested upto my limit of 11% per stocks in portfolio (BHEL is an exception...), and I sense it has also run up beyond my calculated IV, too fast in last 45 days, its prudent to reduce some exposure. Now my total BFSI exposure is 8.2% and only stock being PNB, which I still believe, my current average cost is around 710 (after a net loss to date of about 15% of my current holding.

Since I reduced about 14% invested amount by these actions, I also reallocated some money, and completed purchase in BHARTIARTL to 11%. Yes, I bought it a little expensive, but given the fact that it's making a very strong base around 260 levels, and my conservative IV calculation only gives a 10% lower price, I'm comfortable in buying a good business with healthy prospects at a slightly higher price than my IV. This is a classic example where my conviction in business future prospect is stronger than my confidence in correctness of IV calculation.

Additionally, now that I've 9 stocks, I also have room to add a new stock, and out of my watchlist, MAZDA is one business which I like. There has been some good discussion on SN forum, and its been few weeks that we've waited to assimilate the discussion, and my gut feel says - go ahead. Strong business fundamental, undervalued by a conservative IV calculation method, healthy record of cash flow generation, decent dividend yield, and no debt. Just the right kind of company you'd want to buy in. Yes, Ideally I'd like to buy below Rs 87, but again, giving benefit of doubt in IV calculation, since its only about 12% higher, and started buying in small amounts. As it falls, I've surplus cash from sale of banking stocks to gradually build up exposure in MAZDA. Thanks Sanjeev Ji for analyzing this good stock.

Finally, here's my new portfolio allocation, by stocks:

And this is by sector. Yes, my exposure in Capital goods sector is above 30%, primarily due to good run up in BHEL and the fact that BHEL alone stands at 17% in my portfolio. But I strongly believe in the business prospects, and in long term, both BHEL and CROMPGREAV will deliver - they're healthy businesses, run by able management, and there's a huge potential for both these companies to grow further given the large power infrastructure need in India. Yes, there's competition, but these are good brands which enjoy reputation of quality products, and eventually, quality wins in such mammoth investment spaces.

Thursday, October 04, 2012

Readjustments

I took the first step of what I mentioned in planned investments. The new allocation looks as below

Here's the detail:

1. ALBK has run up from a low of Rs 117 odd to Rs 150 in last 40 days. This is quite fast. I did some bottom fishing around Rs 125 and below, and considering that I only took it as a beaten down stock, and not really a great long term investment, I should reduce some exposure and take profits. I did so, and reduce about 14% holding yesterday at Rs 150. As the stock will increase further, I'll offload further, and bring down portfolio contribution of ALBK to less than 7%, and possibly exit completely if I stop a much better opportunity.

2. CROMPGREAV has also run up from a low of Rs 103 to Rs 130 pretty fast. Again, prudent to reduce some exposure considering quite high a cost in comparison to IV as mentioned in my post earlier. It'll come down when people get sense out of this liquidity driven rally, and then I'll buy back again when it comes below the IV. Yes, it may not happen, but then I'll only offload upto 20% of my holdings. I reduced about 12.5% yesterday, and will take another offloading to reduce cost and risk (considering I really have a negative margin of safety on this stock)

3. I took some more exposure in IGL & BHARTIARTL. As I mentioned in my post on these company, I strongly believe in future prospects, and although current price is about 10% higher than my IV calculations, I'm taking some risk in buying a bit higher since I believe that long term growth prospects offset the risk adequately. This is a classic case of buying slightly higher than calculated fair price if you believe that IV will grow in the future, and opportunity cost of investment is justified (more on this topic soon...)

Let's wait more for this rally to unfold, will take some more prudent calls to reduce exposure in opportunities where I don't believe quite strongly and which are more of Graham like opportunities (ALBK, PNB, and CROMPGREAV to reduce risk due to negative MoS), and wait for downhill movement to pick more of BHARTIARTL, IGL and INFY.

On OPTOCIRCUITS, I'll hold further purchase till I get time to analyze it deeper, especially the incremental return on capital and success of acquisitions and goodwill writeoff.

Here's the detail:

1. ALBK has run up from a low of Rs 117 odd to Rs 150 in last 40 days. This is quite fast. I did some bottom fishing around Rs 125 and below, and considering that I only took it as a beaten down stock, and not really a great long term investment, I should reduce some exposure and take profits. I did so, and reduce about 14% holding yesterday at Rs 150. As the stock will increase further, I'll offload further, and bring down portfolio contribution of ALBK to less than 7%, and possibly exit completely if I stop a much better opportunity.

2. CROMPGREAV has also run up from a low of Rs 103 to Rs 130 pretty fast. Again, prudent to reduce some exposure considering quite high a cost in comparison to IV as mentioned in my post earlier. It'll come down when people get sense out of this liquidity driven rally, and then I'll buy back again when it comes below the IV. Yes, it may not happen, but then I'll only offload upto 20% of my holdings. I reduced about 12.5% yesterday, and will take another offloading to reduce cost and risk (considering I really have a negative margin of safety on this stock)

3. I took some more exposure in IGL & BHARTIARTL. As I mentioned in my post on these company, I strongly believe in future prospects, and although current price is about 10% higher than my IV calculations, I'm taking some risk in buying a bit higher since I believe that long term growth prospects offset the risk adequately. This is a classic case of buying slightly higher than calculated fair price if you believe that IV will grow in the future, and opportunity cost of investment is justified (more on this topic soon...)

Let's wait more for this rally to unfold, will take some more prudent calls to reduce exposure in opportunities where I don't believe quite strongly and which are more of Graham like opportunities (ALBK, PNB, and CROMPGREAV to reduce risk due to negative MoS), and wait for downhill movement to pick more of BHARTIARTL, IGL and INFY.

On OPTOCIRCUITS, I'll hold further purchase till I get time to analyze it deeper, especially the incremental return on capital and success of acquisitions and goodwill writeoff.

Subscribe to:

Posts (Atom)